Why “normal-for-longer” interest rate could boost US regional banks returns

Investors remain focused on the timing of US Federal Reserve (Fed) interest rate cuts. With Fed Chairman Jerome Powell recently indicating that rate cuts will begin in September, the market has reacted favourably towards US banks. We explain why historically a “normal-for-longer” interest rate environment has been a good time to invest in US banks.

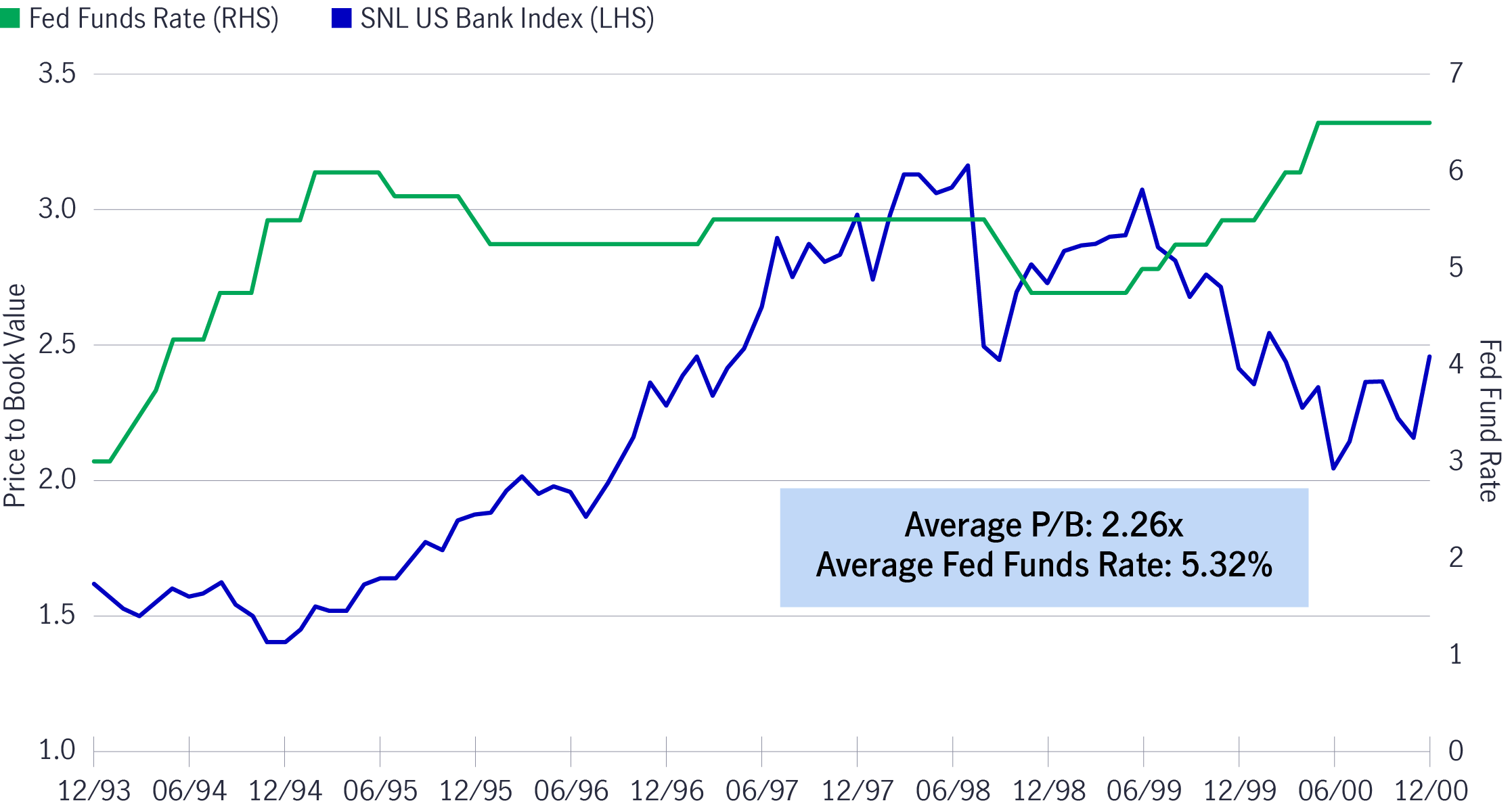

A case in point was the Fed’s aggressive raising of interest rates in 1994. The following period, which extended into the beginning of the next decade, was a fruitful period to invest in the banking sector as the Fed maintained a normalized interest rate range. For instance, the price-to-book ratio (P/B ratio)1 across the banking segment expanded from less than 1.5 times in 1994 to 3 times by 1998 (Chart 1). In fact, the banking sector represented by the S&P Composite 1500 Banks Index returned over 49% annually from January 1995 to December 1997.

Chart 1: Bank multiples expansion in a higher rate environment

Will returns be as robust following the current rate hiking cycle? There will certainly be differences, but there are many reasons to believe that a similar stretch of sustained strong performance may materialise.

Bank revenues are expected to move higher

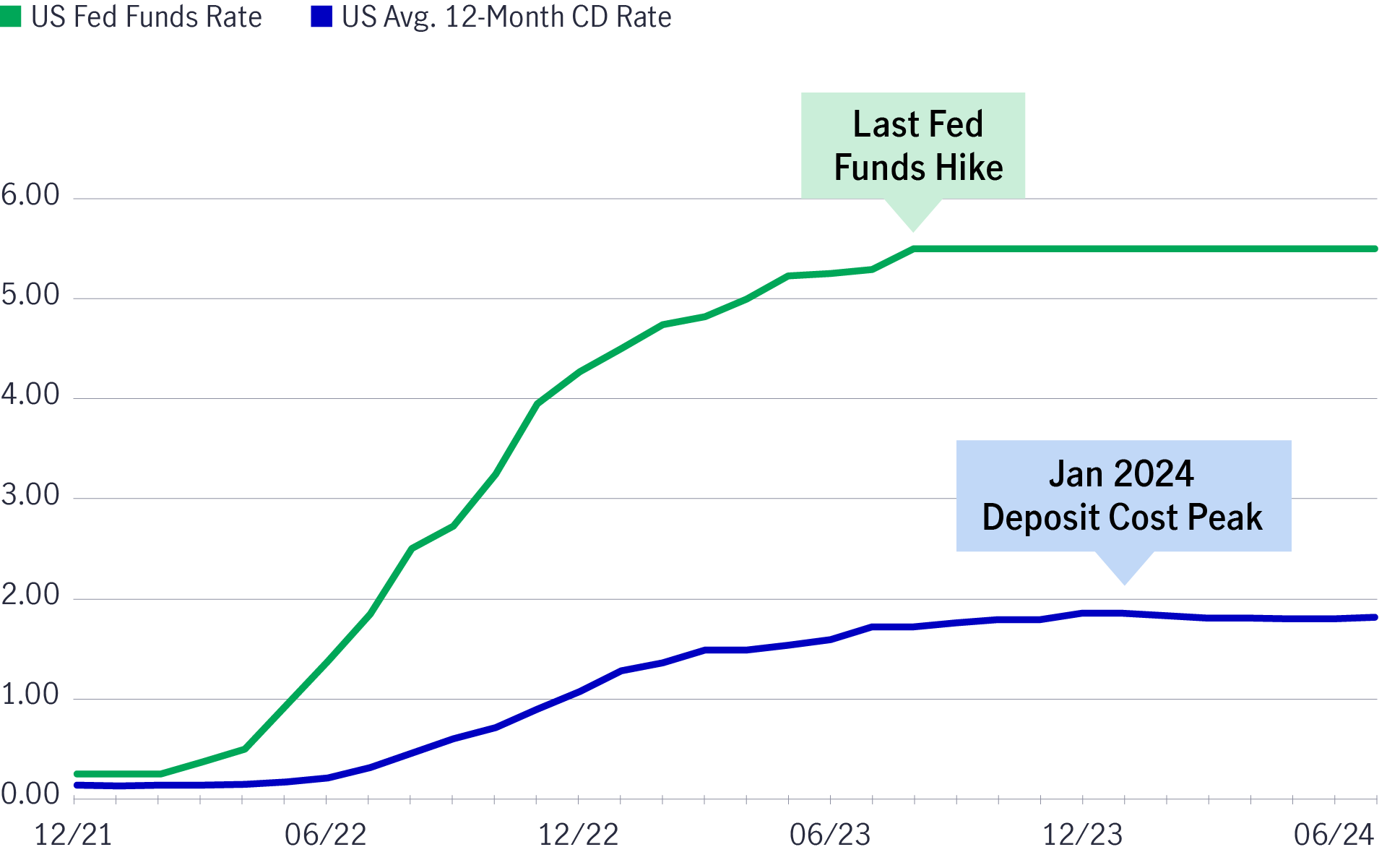

Most banks are currently underearning. In 2023, following the rapid increase in short-term interest rates by the Fed, deposit costs rose faster than loan yields. This negatively affected profit margins and earnings as the cost of the banks’ liabilities increased more quickly than their earning assets. However, we believe this negative impact has nearly run its course, as deposit costs have stabilized (Chart 2). Even with rate cuts on the horizon, regional banks’ revenues are expected to spring higher over the next few years as the banks have a significant amount of loans and securities set to reprice meaningfully higher. Coupled with an increased prospect of lower deposit costs, we believe this creates a strong outlook for net interest revenue over the medium term.

Chart 2: Plateauing deposit cost following Fed funds rate hikes

The median bank has 45% of its loans at a fixed interest rate, meaning the interest rate is constant until maturity.2 Typically, these loans have a five-year maturity. As such, the portion of its loans that originated in the low interest-rate environment of 2020-2022 will mature and be replaced with loans at much higher levels over the next few years. This could significantly boost revenues.

Additionally, banks' securities portfolios are commonly four to five years in duration and comprise 10-20% of earnings assets. Similar to their loan portfolios, we believe banks will see additional revenue growth when these securities mature and are replaced with higher-yielding assets. In short, we believe that most bank revenues are at an inflection point and will move higher over the next few years, irrespective of the timing and pace of Fed rate cuts.

Lower valuations further enhance the return potential

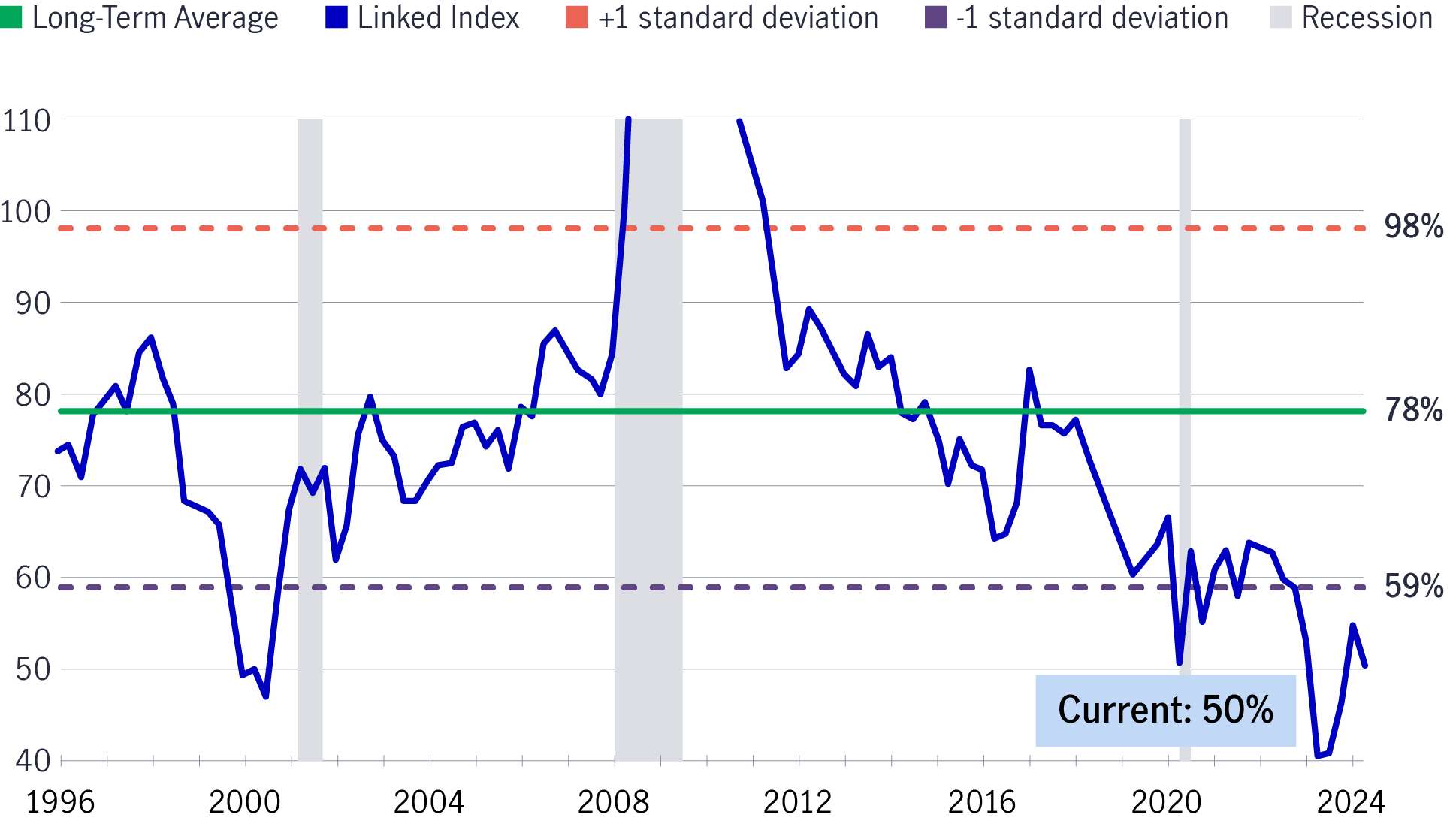

Typically, when a company is underearning, its earnings multiple (price-to-earnings ratio) will often trade at a premium as investors expect a near-term recovery. This was observed during the period (2006 to 2014) surrounding the global financial crisis when banking stocks consistently traded above their long-term average compared to the earnings multiples seen across the broader market (Chart 3).

Chart 3: Steep discount compared to the broader market creates opportunity

Yet, this is currently not the case. Banks are trading at just over 50% of the broader market’s earnings multiple, which is below their long-term average of 78%. This leaves significant room for valuation expansion as revenues move higher.

Even with the recent outperformance – which we believe may have been aided by the expectations of a Fed cut and the improving fundamentals evident in Q2 earnings results – valuations are still significantly discounted relative to the broader market. Specifically, regional banks are trading at 11.0 times their 2025 forward P/E ratio compared to the broader US market at 20.2 times for 20253. We believe the attractive relative valuation of banks coupled with expectations for double-digit earnings growth in 2025 and 2026 signals the potential for continued strong outperformance.

Could rate cuts spoil the opportunity?

We don’t think so. The market has reacted favourably toward US regional banks following

Chairman Powell’s announcement that strongly suggested an interest-rate adjustment by the Fed is forthcoming. We believe a monetary easing cycle may act as a catalyst that helps unlock value, as bank valuations have been hampered by investors’ concerns over the impact of the Fed’s aggressive tightening cycle. Over a 16-month period from March 2022 to July 2023 the fed funds rate increased by over five percentage points to a target of 5.25% – 5.50%.

In the event incoming data following rate cuts leads the Fed to reverse their course and there are additional rate hikes, it may raise deposit costs and lead to a further erosion of net-interest margins. In turn, it could also have delayed any revenue growth from the asset repricing we are beginning to see.

Secondly, a hike may increase the persistent fears about the health of the commercial real estate market. We believe that the apprehension surrounding commercial real-estate risk on bank balance sheets has been overstated and somewhat disconnected from reality.

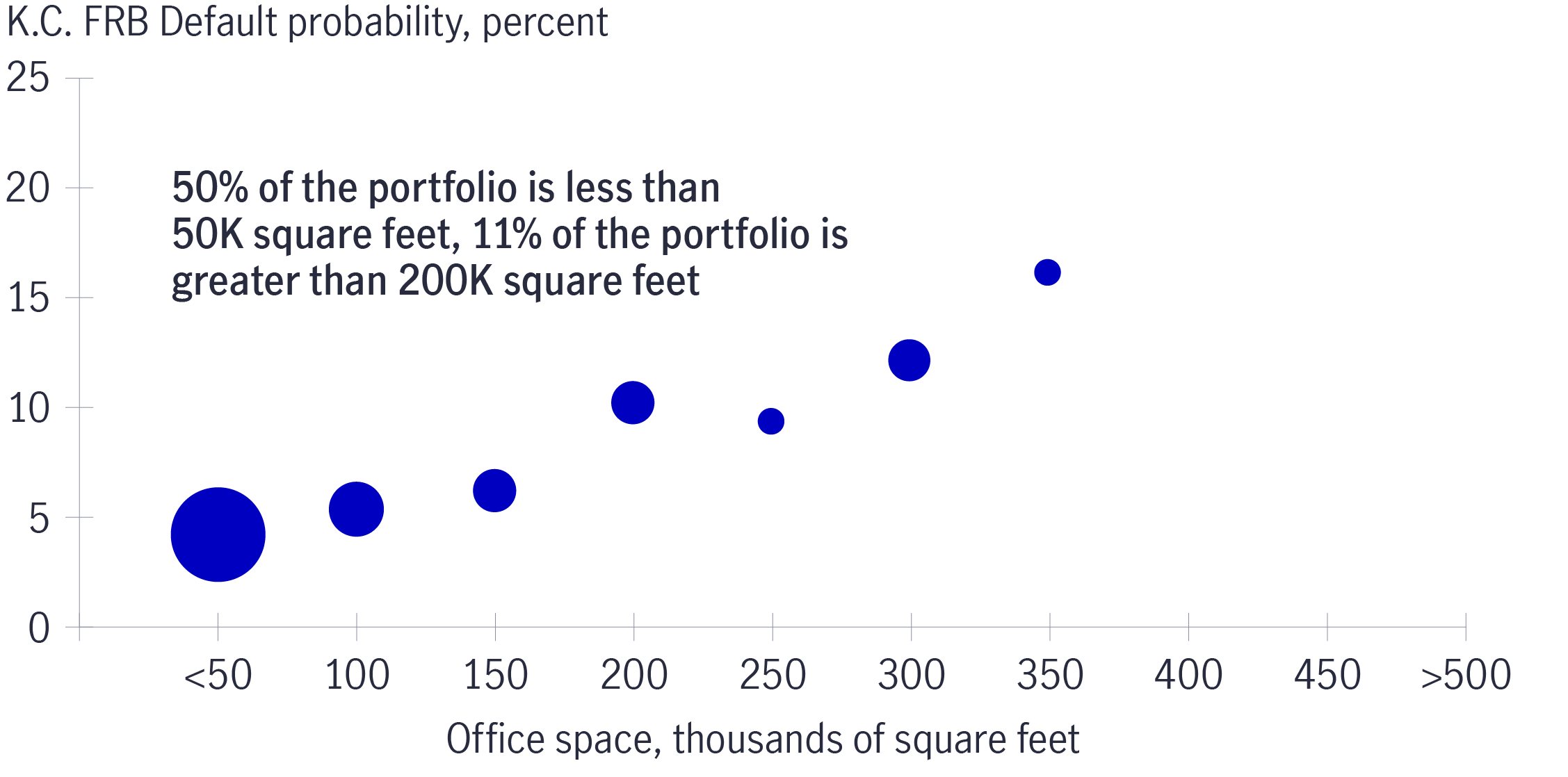

While banks do have exposure to commercial real estate, most underwriting to real estate property firms have had conservative loan-to-value ratios. Moreover, regional banks have minimal exposure to large office assets located in central business districts, where most of the risk lies in this asset class (Chart 4 and Chart 5). In fact, in the second quarter of 2024, the median small- and mid-sized bank experienced only nine basis points of net loan charge-offs, a historically low level4. While there may be some credit losses, we do not believe the issue is systemic. Additionally, banks have established substantial reserves to absorb potential loan losses.

Chart 4: Federal Reserve Bank of Kansas City: Expected default rates on

office properties increased with property size

Chart 5: Office portfolio by property size of a typical US regional bank

The concerns over higher deposit costs and commercial real estate exposure should be dampened given expectations of a rate cut in September. Lower borrowing costs for commercial real estate borrowers should act as a catalyst to bank multiples as fears around their debt service burden subside. If we look back to mid-1995, when the Fed began pivoting towards monetary easing, it sparked a significant improvement in bank valuations. While we don’t know how the market will treat such a move in 2024, history tells us it should benefit valuations.

1 The price-to-book (P/B) ratio measures the market's valuation of a company relative to its book value. Assume the book value remains unchanged, a raise in P/B ratio indicates the stock price increases. 2 Data from Janney Montgomery Scott, 6/3/2024. 3 Source: FactSet, data as of 31 May 2024. Regional banks are represented by S&P Regional Banks Select Industry Index. Broader US market is represented by S&P 500 Index. It is not possible to directly invest in an index. 4 Data from KBW as of 8/2/2024.

Investing involves risks, including the potential loss of principal. Financial markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. These risks are magnified for investments made in emerging markets. Currency risk is the risk that fluctuations in exchange rates may adversely affect the value of a portfolio’s investments.

The information provided does not take into account the suitability, investment objectives, financial situation, or particular needs of any specific person. You should consider the suitability of any type of investment for your circumstances and, if necessary, seek professional advice.

This material is intended for the exclusive use of recipients in jurisdictions who are allowed to receive the material under their applicable law. The opinions expressed are those of the author(s) and are subject to change without notice. Our investment teams may hold different views and make different investment decisions. These opinions may not necessarily reflect the views of Manulife Investment Management or its affiliates. The information and/or analysis contained in this material has been compiled or arrived at from sources believed to be reliable, but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness, or completeness and does not accept liability for any loss arising from the use of the information and/or analysis contained. The information in this material may contain projections or other forward-looking statements regarding future events, targets, management discipline, or other expectations, and is only current as of the date indicated. The information in this document, including statements concerning financial market trends, are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Manulife Investment Management disclaims any responsibility to update such information.

Neither Manulife Investment Management or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained here. All overviews and commentary are intended to be general in nature and for current interest. While helpful, these overviews are no substitute for professional tax, investment or legal advice. Clients should seek professional advice for their particular situation. Neither Manulife, Manulife Investment Management, nor any of their affiliates or representatives is providing tax, investment or legal advice. This material was prepared solely for informational purposes, does not constitute a recommendation, professional advice, an offer or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security or adopt any investment strategy, and is no indication of trading intent in any fund or account managed by Manulife Investment Management. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification or asset allocation does not guarantee a profit or protect against the risk of loss in any market. Unless otherwise specified, all data is sourced from Manulife Investment Management. Past performance does not guarantee future results.

Manulife Investment Management

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. We draw on more than a century of financial stewardship to partner with clients across our institutional, retail, and retirement businesses globally. Our specialist approach to money management includes the highly differentiated strategies of our fixed-income, specialized equity, multi-asset solutions, and private markets teams—along with access to specialized, unaffiliated asset managers from around the world through our multimanager model.

This material has not been reviewed by, is not registered with any securities or other regulatory authority, and may, where appropriate, be distributed by the following Manulife entities in their respective jurisdictions. Additional information about Manulife Investment Management may be found at manulifeim.com/institutional

Australia: : Manulife Investment Management Timberland and Agriculture (Australasia) Pty Ltd, Manulife Investment Management (Hong Kong) Limited. Canada: Manulife Investment Management Limited, Manulife Investment Management Distributors Inc., Manulife Investment Management (North America) Limited, Manulife Investment Management Private Markets (Canada) Corp. Mainland China: Manulife Overseas Investment Fund Management (Shanghai) Limited Company. European Economic Area: Manulife Investment Management (Ireland) Ltd. which is authorised and regulated by the Central Bank of Ireland Hong Kong: Manulife Investment Management (Hong Kong) Limited. Indonesia: PT Manulife Aset Manajemen Indonesia. Japan: Manulife Investment Management (Japan) Limited. Malaysia: Manulife Investment Management (M) Berhad 200801033087 (834424-U) Philippines: Manulife Investment Management and Trust Corporation. Singapore: Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration No. 200709952G) South Korea: Manulife Investment Management (Hong Kong) Limited. Switzerland: Manulife IM (Switzerland) LLC. Taiwan: Manulife Investment Management (Taiwan) Co. Ltd. United Kingdom: Manulife Investment Management (Europe) Ltd. which is authorised and regulated by the Financial Conduct Authority

United States: John Hancock Investment Management LLC, Manulife Investment Management (US) LLC, Manulife Investment Management Private Markets (US) LLC and Manulife Investment Management Timberland and Agriculture Inc. Vietnam: Manulife Investment Fund Management (Vietnam) Company Limited.

Manulife, Manulife Investment Management, Stylized M Design, and Manulife Investment Management & Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.

3801668