Assessing China’s latest stimulus measures

In the wake of coordinated policy announcements from Beijing last month, investors swiftly reappraised their views of the China equity market, which rallied sharply in the final week of September and early October. Kai-Kong Chay, senior portfolio manager, greater China equities, and the greater China equities team analyze the latest round of stimulus measures and explain why it warrants more than short-term tactical attention.

Since late September, there’s been a raft of coordinated policy announcements aimed at bolstering China’s economy on multiple fronts. These include a basket of rate and ratio cuts, supportive measures for the property market and stock market liquidity, fiscal stimulus, and shoring up the banks’ capital positions.1

We believe this concerted, multipronged approach can empower individuals, corporates, banks, and non-bank financial institutions to engage and participate in economic activities. Compared to the previous round of concerted measures announced in July, this round of monetary easing and fiscal stimulus spans different areas, such as the property market, consumption, and financials, which should boost investors’ confidence in China’s economy.

A basket of rate and ratio cuts

The latest round of monetary easing spans policy rates, the reserve required ratio (RRR), and mortgage rates:

- A 0.2 percentage point policy rate (7-day reverse repo) cut, with a 0.5 percentage point reduction in the RRR. Depending on conditions, the People’s Bank of China (PBoC) highlighted the possibility of a further RRR cut of 0.25 percentage points to 0.5 percentage points by the end of this year.

- A 0.5 percentage point cut to the existing mortgage rate.

- The minimum down payment ratio for second homes was reduced from 25% to 15%.

Liquidity injection planned for the stock market

To further facilitate access to funding, an RMB 500 billion asset swap facility will be set up by the PBoC for non-bank financial (mutual funds, insurers, and brokers) to borrow directly from the PBoC with their quality collateral.2 In addition, there will be an RMB 300 billion relending program for corporate buybacks, which could help to extend the pace of stock repurchases.

Fiscal stimulus

On October 8, the National Development and Reform Commission (NDRC) laid out incremental policies to step up fiscal measures, including:

- Accelerating special purpose bond issuance to local government to support growth

- Encouraging private capital to participate in major infrastructure projects, including railways, energy, water conservancy, etc.

- Forming a new list of key private investment nationwide

- Supporting private capital to issue infrastructure real estate investment trusts. The NDRC said that it would front-load RMB 100 billion (US$14.1 billion) from the 2025 central budget, with priority given to supporting key urban renewal projects.

The NDRC added that its focus on plans to expand domestic demand, promote consumption, digest the stock of housing, and support the property and capital markets would help the economy achieve a target of about 5% growth for the year.

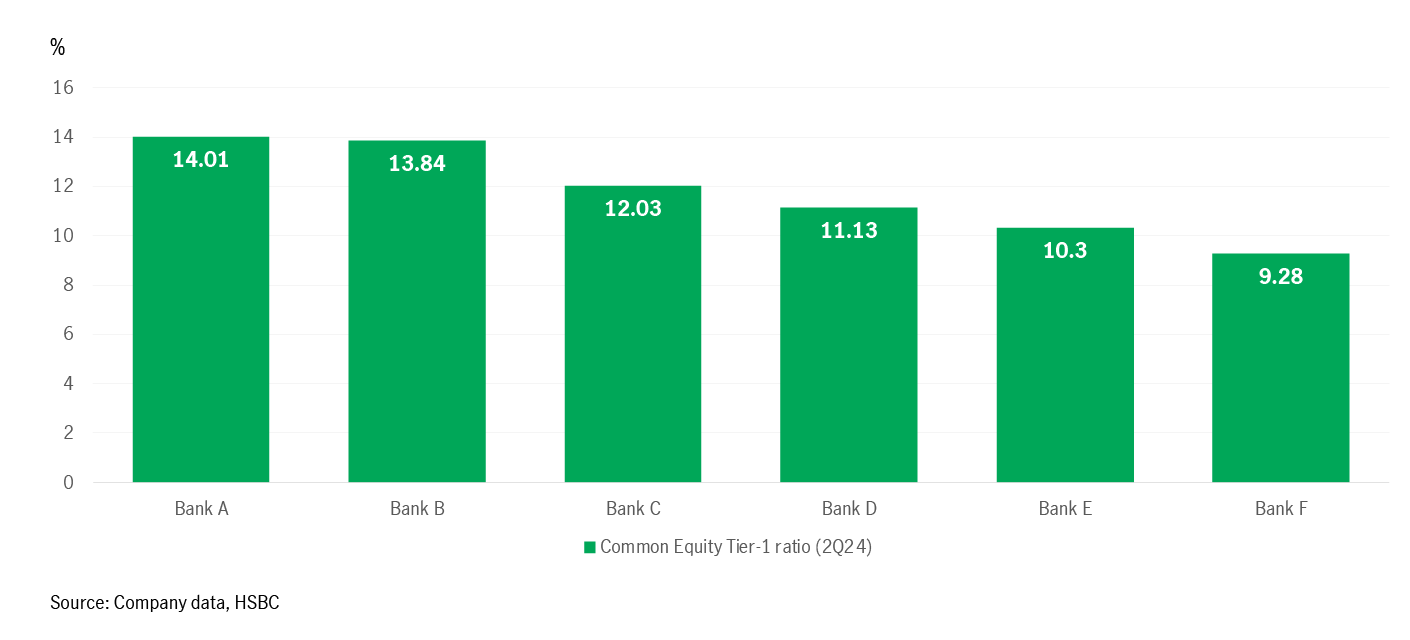

Shoring up bank capital

The National Financial Regulatory Administration is aiming for a phased strengthening of the core Tier-1 ratios of the six major state-owned banks in China. We view this as a significant move and is the first time it’s happened since 2008. Chinese banks were well capitalised with solid core Tier-1 capital adequacy ratios before the announcement. However, the earnings of Chinese banks in 1H 2024 suffered due to weaker-than-expected loan growth. Therefore, the announcement to inject fresh capital into the large state-owned banks is clearly positive for the China banking sector.

Common Equity Tier-1 ratios for six state-owned banks

Our assessment of the announced stimulus

Since 2022, diverging China-U.S. monetary policies have constrained China’s policymakers’ ability to pursue a more aggressive easing policy. With the beginning of the U.S. rate cut cycle in September, China has more room to conduct comprehensive monetary easing to improve the system’s overall liquidity and trigger immediate spillover impacts on the physical economy. Lower effective lending rates and deposit costs are positive for Chinese banks, while a lower RRR could provide the banking system with longer-term liquidity (estimated to be RMB 1 trillion).

By lowering existing mortgage rates and allowing existing mortgage payers to refinance their existing home loans based on a lower rate, an estimated RMB 150 billion in interest savings could be released back to mortgage payers, increasing their discretionary spending power.3

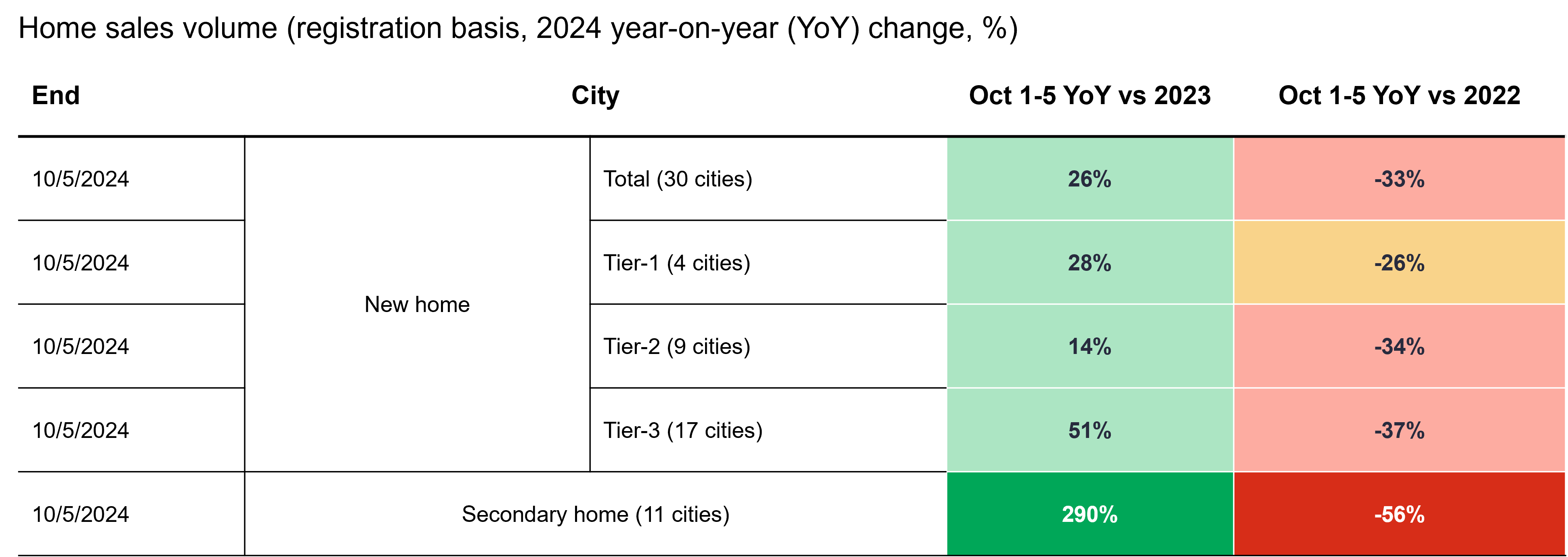

In stimulating the demand for property, a cut in mortgage rates and the down payment ratio should help improve home affordability and encourage potential buyers to enter the property market, which is critical to reigniting property market transaction volumes.

Property volume green shoots during the Golden Week

Shortly after the policy announcement on September 24, immediate positive action was seen on the ground. During the Golden Week holiday, cities that offered home purchase discounts recorded at least a 50% increase in project viewings, according to the Ministry of Housing and Urban-Rural Development.

Home sales during the Golden Week holiday (October 1 to October 5, 2024)

Implications for investors’ positioning

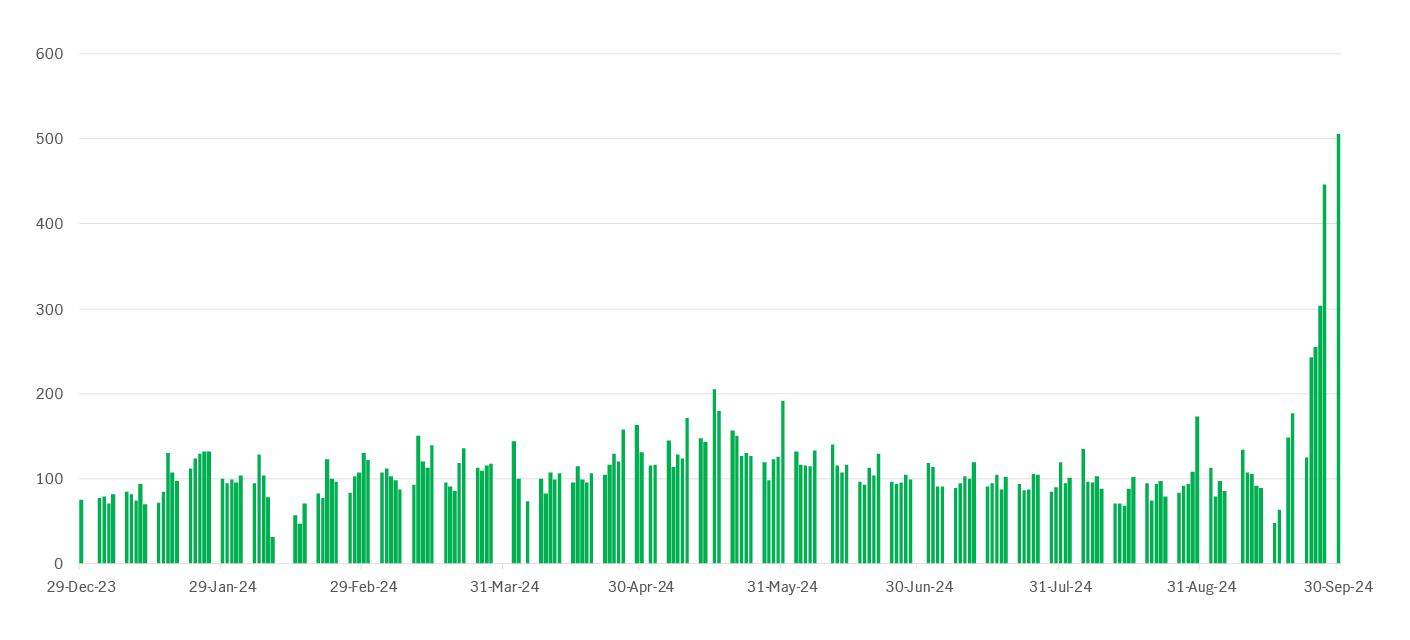

Shortly after the policy announcements were made, transaction activity and volume for the Hong Kong equity markets picked up across the board, and daily turnover recorded a historic high. Valuations also improved but were still below historical averages.

Stock market turnover in Hong Kong reached a historical high (billion, HK dollar)

In the near term, potential catalysts include the following:

- More monetary policy easing is expected: The PBoC has already indicated its intention to lower RRR by another 50 basis points, which indicates China’s determination to stimulate the economy and support the property sector.

- Potential fiscal policy announcements: The NDRC laid out plans to step up fiscal measures and announced incremental policies, which include speeding up special purpose bond issuance to local governments to support regional economic growth, supporting urban renewal projects, encouraging private capital to participate in infrastructure projects, as well as supporting more eligible private capital projects including issuing infrastructure REITs.

- Property: More relaxation in home purchase restrictions, continued policy support for urbanisation, and an implementation facility for housing destocking will also be supportive.

- Consumption: China has announced 20 key steps to boost service consumption in August. Potential government step-up funding support for consumer goods trade-in and equipment upgrade programs should drive further recovery for the consumer sector over the next few months.

Going into the fourth quarter of 2024, we view these sectors favourably:

- Industrials: We favour auto parts manufacturers and advanced manufacturing leaders, as their earnings stood out from their peers in the first half of 2024, with more substantial growth and revenue guidance, as well as market share gains.

- Information technology (IT): We favour IT and hardware tech companies that will benefit from the global smartphone recovery.

- Healthcare: We favour subsectors such as biopharma and medical equipment companies with robust pipelines, competitive, high-quality products, and a go-global strategy.

In conclusion, we believe mainland China/Hong Kong equity markets are at an important juncture that deserves investors’ attention. The kick-starting of the U.S. rate-cutting cycle is positive for mainland China/Hong Kong equity markets and interest-rate-sensitive sectors. We’ve seen first-half 2024 earning upward revisions across MSCI China sectors and China corporates are valuing up, with nearly 600 companies announcing interim dividends this year the highest ever.

We see gradual improvements in China’s property sector, coupled with China’s stimulus measures. We think Chinese companies have competitive go-to global strategies that will enable them to gain market share overseas despite headwinds.

1 China's central bank unveils most aggressive stimulus since pandemic | Reuters; China's central bank cuts RRR by 50 basis points to strengthen market confidence - Global Times. 2 PBOC to set up US$71 billion swap facility to prop up stock market | South China Morning Post (scmp.com) 3 Manulife Investment Management estimates, as of October 8 2024.

Investing involves risks, including the potential loss of principal. Financial markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. These risks are magnified for investments made in emerging markets. Currency risk is the risk that fluctuations in exchange rates may adversely affect the value of a portfolio’s investments.

The information provided does not take into account the suitability, investment objectives, financial situation, or particular needs of any specific person. You should consider the suitability of any type of investment for your circumstances and, if necessary, seek professional advice.

This material is intended for the exclusive use of recipients in jurisdictions who are allowed to receive the material under their applicable law. The opinions expressed are those of the author(s) and are subject to change without notice. Our investment teams may hold different views and make different investment decisions. These opinions may not necessarily reflect the views of Manulife Investment Management or its affiliates. The information and/or analysis contained in this material has been compiled or arrived at from sources believed to be reliable, but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness, or completeness and does not accept liability for any loss arising from the use of the information and/or analysis contained. The information in this material may contain projections or other forward-looking statements regarding future events, targets, management discipline, or other expectations, and is only current as of the date indicated. The information in this document, including statements concerning financial market trends, are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Manulife Investment Management disclaims any responsibility to update such information.

Neither Manulife Investment Management or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained here. All overviews and commentary are intended to be general in nature and for current interest. While helpful, these overviews are no substitute for professional tax, investment or legal advice. Clients should seek professional advice for their particular situation. Neither Manulife, Manulife Investment Management, nor any of their affiliates or representatives is providing tax, investment or legal advice. This material was prepared solely for informational purposes, does not constitute a recommendation, professional advice, an offer or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security or adopt any investment strategy, and is no indication of trading intent in any fund or account managed by Manulife Investment Management. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification or asset allocation does not guarantee a profit or protect against the risk of loss in any market. Unless otherwise specified, all data is sourced from Manulife Investment Management. Past performance does not guarantee future results.

Manulife Investment Management

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. We draw on more than a century of financial stewardship to partner with clients across our institutional, retail, and retirement businesses globally. Our specialist approach to money management includes the highly differentiated strategies of our fixed-income, specialized equity, multi-asset solutions, and private markets teams—along with access to specialized, unaffiliated asset managers from around the world through our multimanager model.

This material has not been reviewed by, is not registered with any securities or other regulatory authority, and may, where appropriate, be distributed by the following Manulife entities in their respective jurisdictions. Additional information about Manulife Investment Management may be found at manulifeim.com/institutional

Australia: : Manulife Investment Management Timberland and Agriculture (Australasia) Pty Ltd, Manulife Investment Management (Hong Kong) Limited. Canada: Manulife Investment Management Limited, Manulife Investment Management Distributors Inc., Manulife Investment Management (North America) Limited, Manulife Investment Management Private Markets (Canada) Corp. Mainland China: Manulife Overseas Investment Fund Management (Shanghai) Limited Company. European Economic Area: Manulife Investment Management (Ireland) Ltd. which is authorised and regulated by the Central Bank of Ireland Hong Kong: Manulife Investment Management (Hong Kong) Limited. Indonesia: PT Manulife Aset Manajemen Indonesia. Japan: Manulife Investment Management (Japan) Limited. Malaysia: Manulife Investment Management (M) Berhad 200801033087 (834424-U) Philippines: Manulife Investment Management and Trust Corporation. Singapore: Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration No. 200709952G) South Korea: Manulife Investment Management (Hong Kong) Limited. Switzerland: Manulife IM (Switzerland) LLC. Taiwan: Manulife Investment Management (Taiwan) Co. Ltd. United Kingdom: Manulife Investment Management (Europe) Ltd. which

is authorised and regulated by the Financial Conduct Authority

United States: John Hancock Investment Management LLC, Manulife Investment Management (US) LLC, Manulife Investment Management Private Markets (US) LLC and Manulife Investment Management Timberland and Agriculture Inc. Vietnam: Manulife Investment Fund Management (Vietnam) Company Limited.

Manulife, Manulife Investment Management, Stylized M Design, and Manulife Investment Management & Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.

3922273