Building a bridge to span decades of retirement

With life expectancy growing, the longevity challenge is real: How do workers prepare for a retirement that’s more easily counted in decades than years? In our tenth annual survey, we spoke to plan participants and retirees to learn how they’re feeling about their finances, and how retirement reality compares to retirement dreams. By understanding the gap, we can help participants build a bridge that covers their potential decades of retirement.

The relationship between financial resilience and longevity

Even accounting for the pandemic, Americans are living longer, healthier lives. Between 1950 and 2021, the portion of the population older than 65 nearly doubled.1 Life expectancy is close to 80, and the number of Americans living 100 years or more is expected to quadruple in the next 30 years.

When the retirement age was 65 and life expectancy was 68,2 retirement planning accounted for a few years. Longevity can bring with it lots of positives: more time to spend with friends and family and enjoying life. It can also bring more decades to pay for living and healthcare expenses.

Building financial resilience in our working years may be more critical than ever as we prepare to live three or more decades. This means being able to navigate financial realities such as debt, college costs, healthcare expenses, and emergencies without derailing retirement savings. Plan sponsors, financial intermediaries, and recordkeepers often play a key role, offering workplace retirement plans supported with financial wellness resources and education.

Delaying retirement can help both sides of the equation

As we see every year, the closer people get to retirement, the better they are at managing their financial stressors—and that holds true, even in retirement. Some people end up retiring later than they’d planned, however, and others earlier. Retirees who retired as planned or later experience the lowest level of financial stress among all generations, and they’re the most optimistic about their retirement savings.

The picture for people who retired earlier than they’d planned, however, is very different.

- Nearly 40% are more stressed now than when they were working

- Over half are unhappy with their financial situation

- 72% wish they’d saved more for retirement

- A third are relying solely on Social Security as their source of income

An individual’s retirement age affects both how much time he or she has to save and how long his or her money may need to last. While workers often have an age in mind, many end up retiring earlier. We discovered that 62% of retirees left the workforce sooner than they’d expected—on average, at age 58 versus their ideal age of 63. This simultaneously shortens their savings period and extends their retirement years.

Retirement timing: expectations vs. reality

| Workers | Retirees | |

| Earlier than planned | 9% | 62% |

| About when planned | 43% | 30% |

| Later than planned | 32% | 3% |

Although early retirees need some extra care, Americans are enjoying retirement

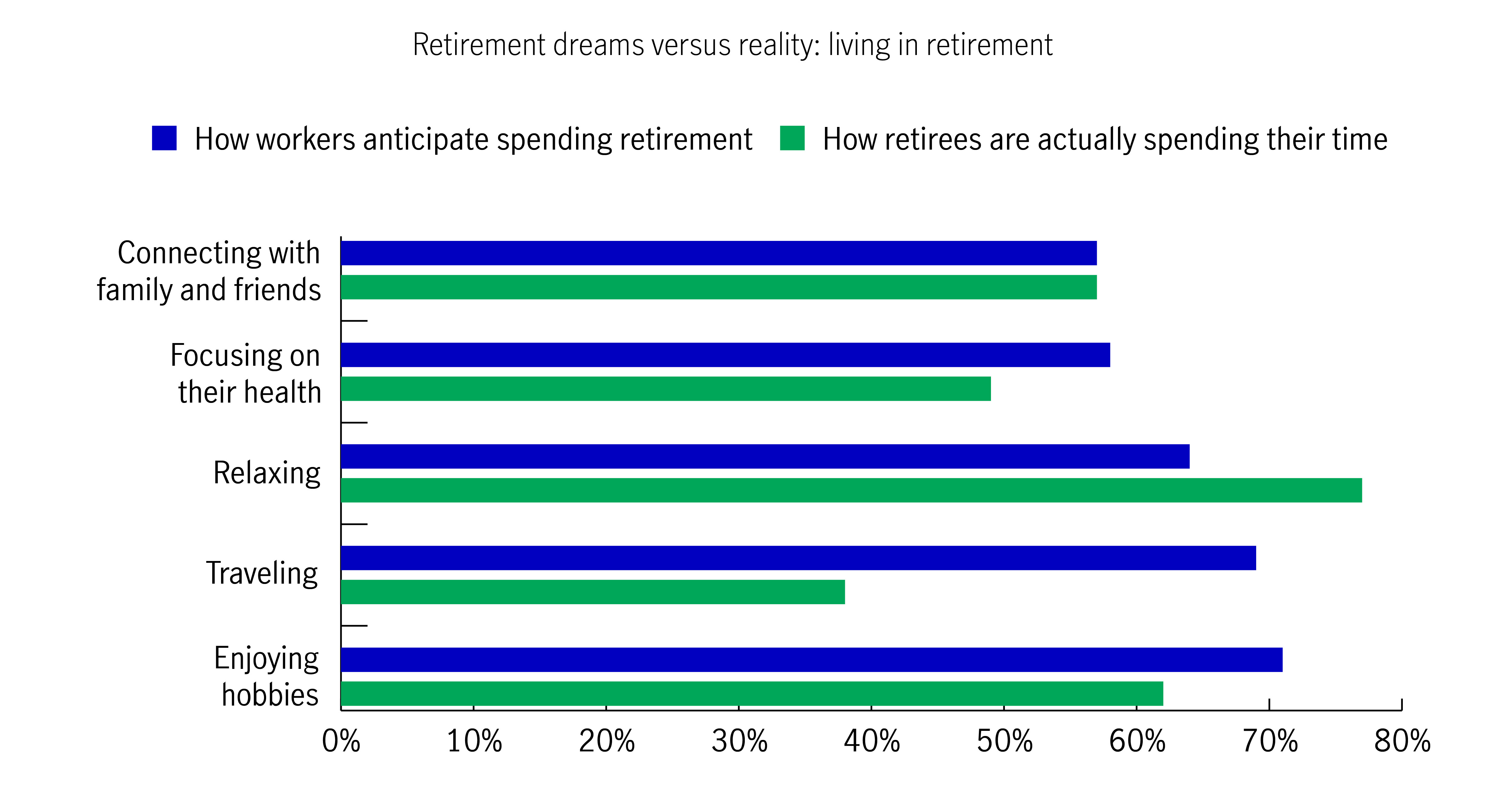

Retirement—like life—has its ups and downs. But the good news is that more than three-quarters of retirees are enjoying themselves. They’re generally doing what they’d expected, although far fewer are traveling than anticipated. Almost half say it’s given them a chance to pursue a passion they hadn’t had time to do before.

But there's a flip side. Six in ten have had to adjust their lifestyle to their cost of living. And although 22% say their social circle has grown, 33% are concerned that their social circle is smaller—a reminder that retirement planning should account for more than just finances.

Smart investing can help savings stretch

With extended time in retirement to plan for, workers need to consider maximizing their saving years and investing wisely. But although older workers and retirees are more knowledgeable about investments than younger workers, there’s still room for improvement. Less than 6 in 10 retirees are knowledgeable about investments.

Retirees are mostly receiving retirement income from annuities and pension plans, but a quarter are only living on Social Security. Reflecting the shift toward defined contribution (DC) plans, most workers we surveyed expect to rely on a 401(k) or 403(b) in retirement.

| Sources of retirement income in addition to Social Security | Retirees | Workers |

| Annuities | 40% | 50% |

| Pension plan | 36% | 29% |

No additional income sources |

26% | 3% |

401(k) or 403(b) |

24% | 84% |

| IRAs | 21% | 39% |

Saving/checking account |

18% | 26% |

| Other investment accounts | 16% | 15% |

| Other | 11% | 9% |

This illustrates the importance of getting people into a DC plan and educating them about investing for the long term. Generally, workers and retirees appear to be following a glide path from more risk to less risk over time. But if a typical glide path provides for 70% to 80% equity exposure when retirement is decades away, it appears that the younger generations could benefit from learning more about diversification strategies.

How the generations have invested their retirement accounts

| Gen Z/millenials | Gen X | Baby boomers | Retirees | |

| Low risk: Lower potential return, lower chance of loss | 17% | 14% | 25% | 40% |

| Medium risk: Medium potential return, medium chance of loss | 43% | 51% | 54% | 33% |

| High risk: Higher potential return, higher chance of loss | 23% | 19% | 12% | 4% |

How we can help Americans enjoy their longevity bonus

Having more years to enjoy after working can be a wonderful adventure, which is why it’s referred to as a longevity bonus. But this also means Americans not only need to consider retirement plans, they also need help saving and investing so they can reach their goals. There’s no magic wand, but by rallying around what I call the five A’s, I think we can help people get there.

- Access—Access to workplace retirement plans is foundational for Americans to be able to save, and they can be supplemented with state-sponsored plans.

- Auto—Auto features have generally been highly successful at solving for inertia and getting people saving in a plan, and SECURE 2.0 was a nice step forward, requiring auto-enroll and auto-increase in most new plans.

- Activation—While auto features get people in a plan, inertia lingers until we get participants actively involved in their plans. Personalizing communications, engagement, and education can help with relevant and timely nudges to take action.

- Alpha—Tax-deferred investment compounded returns may be close to a magic wand, but it doesn’t do the trick when participants’ investment strategies aren’t suitable for their age and risk tolerance. Participant education and engagement should usually start with investment basics and include asset allocation and diversification strategies.

- Advice—To help with alpha, our research shows that participants who work with a financial professional feel better about their finances, are better prepared for retirement, and have less financial stress in their lives.

For more insight from our 10th annual survey, download our Financial resilience and longevity report.3

1 Our World in Data, July 2024. 2 https://www.macrotrends.net/global-metrics/countries/USA/united-states/life-expectancy. 3 2024 John Hancock Financial resilience and longevity report, a commissioned study.

Important disclosures

John Hancock’s 10th annual financial resilience and longevity survey, John Hancock, Edelman Public Relations Worldwide Canada Inc. (Edelman), June 2024. This information is general in nature and is not intended to constitute legal or investment advice. Edelman and John Hancock are not affiliated, and neither is responsible for the liabilities of the other. This report presents the results of research conducted by Edelman on behalf of John Hancock. The objectives of this study were to (1) quantify the financial situation and level of financial stress of John Hancock plan participants and American retirees; (2) determine the key triggers of financial stress; (3) understand the extent to which actions, including actual financial behavior and planning activity, ameliorate stress; (4) assess longevity and retirement preparation and readiness; and (5) investigate custom insight around how retirees are faring in retirement. This was an online survey comprising two participant samples: John Hancock plan participants and American retirees. The John Hancock plan participant sample comprised 2,623 John Hancock plan participants. The survey for this sample was conducted from 5/17/24 through 6/3/24, with an average survey length of approximately 18 minutes per respondent. Respondents were located from a list of eligible plan participants provided by John Hancock. The American retiree sample comprised 525 retired Americans, sourced through Angus Reid’s research panel. The survey for this sample was conducted from 5/13/24 through 5/28/24, with an average survey length of approximately 12 minutes per respondent. All statistical testing is done at 0.95 significance levels. Percentages in the tables and charts may not total to 100 due to rounding and/or missing categories.

The content of this document is for general information only and is believed to be accurate and reliable as of the posting date, but may be subject to change. It is not intended to provide investment, tax, plan design, or legal advice (unless otherwise indicated). Please consult your own independent advisor as to any investment, tax, or legal statements made.

Investing involves risks, including the potential loss of principal. Financial markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. These risks are magnified for investments made in emerging markets. Currency risk is the risk that fluctuations in exchange rates may adversely affect the value of a portfolio’s investments.

The information provided does not take into account the suitability, investment objectives, financial situation, or particular needs of any specific person. You should consider the suitability of any type of investment for your circumstances and, if necessary, seek professional advice.

This material is intended for the exclusive use of recipients in jurisdictions who are allowed to receive the material under their applicable law. The opinions expressed are those of the author(s) and are subject to change without notice. Our investment teams may hold different views and make different investment decisions. These opinions may not necessarily reflect the views of Manulife Investment Management or its affiliates. The information and/or analysis contained in this material has been compiled or arrived at from sources believed to be reliable, but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness, or completeness and does not accept liability for any loss arising from the use of the information and/or analysis contained. The information in this material may contain projections or other forward-looking statements regarding future events, targets, management discipline, or other expectations, and is only current as of the date indicated. The information in this document, including statements concerning financial market trends, are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Manulife Investment Management disclaims any responsibility to update such information.

Neither Manulife Investment Management or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained here. All overviews and commentary are intended to be general in nature and for current interest. While helpful, these overviews are no substitute for professional tax, investment or legal advice. Clients should seek professional advice for their particular situation. Neither Manulife, Manulife Investment Management, nor any of their affiliates or representatives is providing tax, investment or legal advice. This material was prepared solely for informational purposes, does not constitute a recommendation, professional advice, an offer or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security or adopt any investment strategy, and is no indication of trading intent in any fund or account managed by Manulife Investment Management. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification or asset allocation does not guarantee a profit or protect against the risk of loss in any market. Unless otherwise specified, all data is sourced from Manulife Investment Management. Past performance does not guarantee future results.

Manulife Investment Management

Manulife Investment Management is the brand for the global wealth and asset management segment of Manulife Financial Corporation. Our mission is to make decisions easier and lives better by empowering investors for a better tomorrow. Serving more than 19 million individuals, institutions, and retirement plan members, we believe our global reach, complementary businesses, and the strength of our parent company position us to help investors capitalize on today’s emerging global trends. We provide our clients access to public and private investment solutions across equities, fixed income, multi-asset, alternative, and sustainability-linked strategies, such as natural capital, to help them make more informed financial decisions and achieve their investment objectives. Not all offerings are available in all jurisdictions. For additional information, please visit manulifeim.com.

This material has not been reviewed by, is not registered with any securities or other regulatory authority, and may, where appropriate, be distributed by the following Manulife entities in their respective jurisdictions. Additional information about Manulife Investment Management may be found at manulifeim.com/institutional

Australia: Manulife Investment Management Timberland and Agriculture (Australasia) Pty Ltd, Manulife Investment Management (Hong Kong) Limited. Canada: Manulife Investment Management Limited, Manulife Investment Management Distributors Inc., Manulife Investment Management (North America) Limited, Manulife Investment Management Private Markets (Canada) Corp. Mainland China: Manulife Overseas Investment Fund Management (Shanghai) Limited Company. European Economic Area: Manulife Investment Management (Ireland) Ltd. which is authorised and regulated by the Central Bank of Ireland Hong Kong: Manulife Investment Management (Hong Kong) Limited. Indonesia: PT Manulife Aset Manajemen Indonesia. Japan: Manulife Investment Management (Japan) Limited. Malaysia: Manulife Investment Management (M) Berhad 200801033087 (834424-U) Philippines: Manulife Investment Management and Trust Corporation. Singapore: Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration No. 200709952G) South Korea: Manulife Investment Management (Hong Kong) Limited. Switzerland: Manulife IM (Switzerland) LLC. Taiwan: Manulife Investment Management (Taiwan) Co. Ltd. United Kingdom: Manulife Investment Management (Europe) Ltd. which is authorised and regulated by the Financial Conduct Authority. United States: John Hancock Investment Management LLC, Manulife Investment Management (US) LLC, Manulife Investment Management Private Markets (US) LLC and Manulife Investment Management Timberland and Agriculture Inc. Vietnam: Manulife Investment Fund Management (Vietnam) Company Limited.

Manulife, Manulife Investment Management, Stylized M Design, and Manulife Investment Management & Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.

MGR1011243896453