Tax receipts and slips

Bookmark this helpful resource to stay on top of important dates as each tax season approaches.

How do I find my tax receipts and slips online?

Check the posting schedule tab to confirm whether the receipt or slip you want is available online and when, then sign in to find what you're looking for.

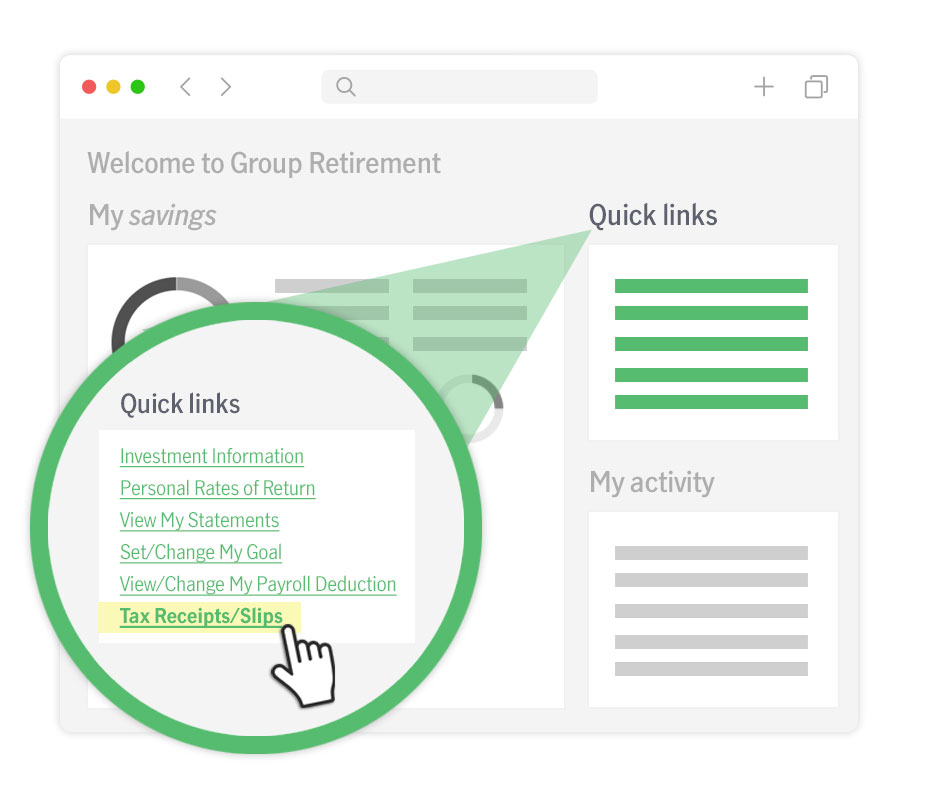

Group retirement members

- Sign in

- Go to Tax Receipts/Slips under Quick links

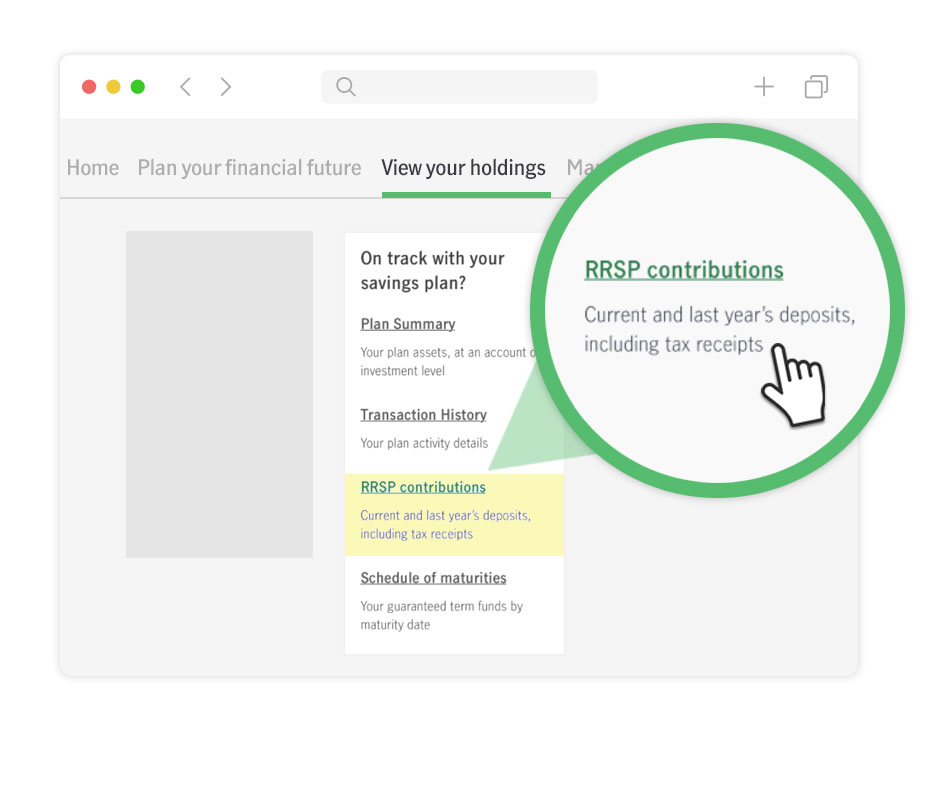

VIP Room—group retirement members

- Sign in

- Go to View your holdings > RRSP contributions

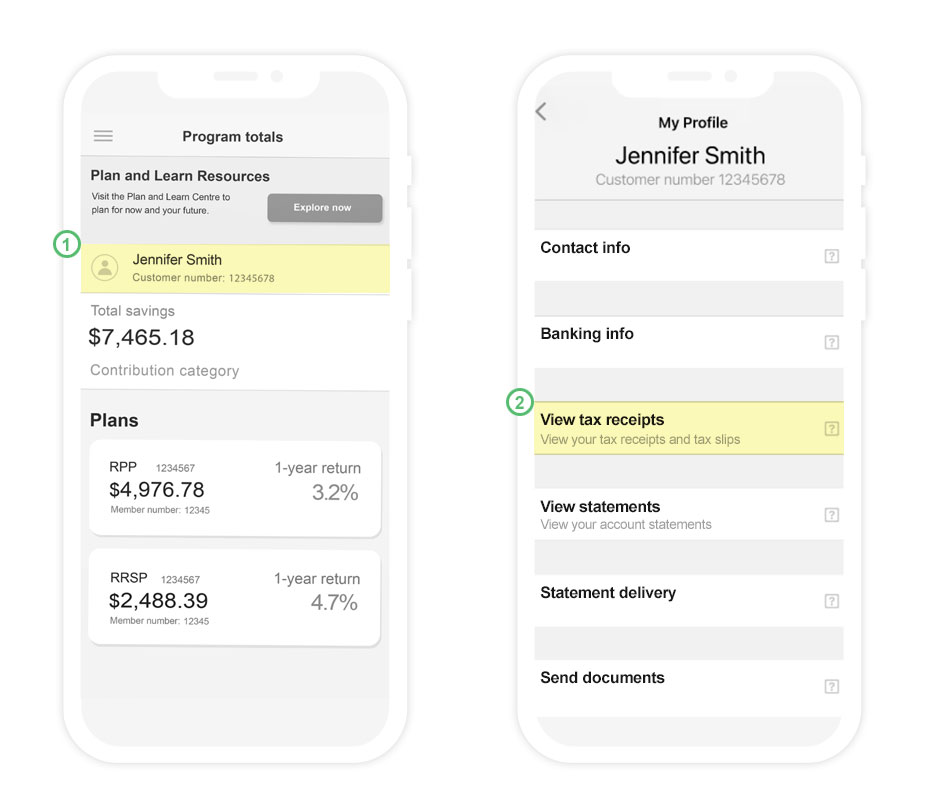

Manulife Mobile app users

- Sign in to your group retirement account on Manulife Mobile

- Go to My Profile (tap on your name) > View tax receipts

Mailing and online posting schedule

Group RRSP contribution receipt

Tax receipt or slip |

Where to find it |

When to expect it |

|---|---|---|

Contribution between March 2024 and December 2024 |

Week of January 20, 2025 |

|

Contribution between March 2024 and December 2024 |

Week of February 3, 2025 |

|

Contribution between March 2024 and December 2024 (VIP Room) |

Week of January 27, 2025 |

|

Contribution within the first 60 days of 2025 |

Week of March 17, 2025 |

|

Contribution within the first 60 days of 2025 |

Week of March 24, 2025 |

Group PRPP or VRSP contribution receipt

RPP contributions

Tax slip |

Where to find it |

|---|---|

Your RPP contributions show on the T4 you get from your employer (and on your Relevé 1 if you're a resident of Québec) |

Ask your employer |

Tax slips

Tax receipt or slip |

Where to find it |

When to expect it |

|---|---|---|

T5008, RL18 |

Week of February 3, 2025 |

|

T5, RL3 |

Week of February 17, 2025 |

|

T5, RL3 (VIP Room) |

Week of February 17, 2025 |

|

T4A, RL2, T4RIF, T4RSP |

Week of February 24, 2025 |

|

T4PS, RL25, T4A-NR |

Week of February 24, 2025 |

|

T3, RL16 |

Week of March 10, 2025 |

|

T3, RL16 (VIP Room) |

and mail |

Week of March 17, 2025 |

NR4 |

Week of March 10, 2025 |

|

NR4 (VIP Room) |

and Mail |

Week of March 17, 2025 |

Contribution and filing deadlines

March 3, 2025, at 11:59 P.M., Eastern time

Your 2024 RRSP contribution deadline

April 30, 2025, at 11:59 P.M., Eastern time

Your 2024 tax return filing deadline

What’s new: changes to capital gains reporting

The April 2024 federal budget introduced an increase to the taxable portion of capital gains—known as the inclusion rate—from 50% to 66.67%. It applies to individuals with over $250,000 in annual capital gains and to all corporations and trusts. On January 31, 2025, Finance Canada announced that the effective date of the proposed capital gains inclusion rate change would now be January 1, 2026.

Due to the late notification of the effective date change, there was insufficient time for the Canada Revenue Agency (CRA)/Revenue Quebec (MRQ) and the financial services industry to adjust 2024 reporting. Therefore, you’ll still see new boxes on your tax forms to report capital gains and/or losses for each period.

For details on how to report these amounts on your return, consult the relevant CRA and MRQ form guides.

How to grow your savings and pay less tax

When you contribute to your RRSP, you benefit now and in the future. It’s a win-win.

- Lower your taxes today

- Invest for tomorrow

- Grow your savings and defer taxes

Got questions about tax receipts and slips?

Learn how to:

- Connect to your online account so you can download your tax receipts and slips

- Switch to online statements

- Make sure your address is up to date

- Put money in your plan

Get more information about:

- Different tax receipts and slips

- What they’re issued for

- Why you need to include them when you file